Aftab Anwar Baloch

Cash processing in Pakistan is a critical component of the country’s financial infrastructure, ensuring liquidity, security, and accessibility in an economy where physical currency still plays a significant role. Despite the rapid proliferation of digital financial services, cash transactions continue to underpin a substantial portion of daily commerce, particularly within the informal sector. With a cash-centric culture and evolving economic dynamics, the efficient management of currency is essential to maintaining public confidence and ensuring the smooth operation of Pakistan’s financial system.

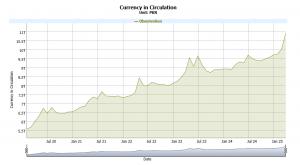

The State Bank of Pakistan (SBP), through its subsidiary SBP Banking Services Corporation (SBP-BSC), is tasked with managing the issuance, distribution, and quality assurance of currency notes and coins. As of FY24, currency in circulation in Pakistan stands at PKR 10.93 trillion, a reflection of the country’s continued reliance on physical cash despite rising digital adoption.

The SBP is responsible not only for managing banknote production but also for overseeing the lifecycle of banknotes from issuance and circulation to the withdrawal, destruction, and swaps fresh notes for those deemed unfit. Although detailed public data on the exact number of notes lodged with the SBP.

Counterfeit detection is a critical focus within cash processing operations. The SBP has taken concrete steps, including the Clean Note Policy that mandates the banks to use state-of-the-art authentication systems and forensic support to identify, isolate, and destroy suspected counterfeits, and the launch of a smartphone app that allows users to verify security features of genuine banknotes. While precise figures for the counterfeit ratio are not routinely published, official statements suggest that the rate of detected counterfeits has remained relatively stable over the past two years.

The SBP has implemented comprehensive strategies & regulations to modernize and automate the cash operations and management process. With the aim to reform cash processing functions within banks, the SBP introduced the Currency Management Strategy (CMS). The strategy mandates that commercial banks issue only machine-authenticated, good-quality notes of higher denominations, to maintain the integrity & quality of currency in circulation. SBP has also approved specific models of Banknote Processing and Authentication Systems (BPAS) and Note Sorting Machines (DNS, CNS), with banks required to calibrate these systems for compliance and quality assurance.

The interbank cash exchange mechanism implemented by the SBP also marks a significant achievement in optimizing cash circulation. This system allows banks to directly trade cash, thereby reducing the reliance on the SBP Banking Services Corporation and streamlining cash logistics. Early indicators suggest that this mechanism has enhanced the efficiency of cash flows between banks, supporting smoother day-to-day operations in the financial sector.

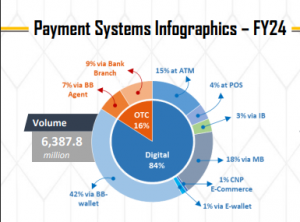

Pakistan has robust banking sector, with 41 scheduled commercial banks, 6 Development Financial Institutions (DFIs), and 2 Microfinance Banks (MFBs) operating under the regulatory oversight of the SBP. Many of these banks have been equipped with the modernized cash processing framework by establishing specialized Cash Processing Centres (CPCs) as mandated by the SBP. The banks can make arrangements with other banks or CPCs to get their cash processed, or they can have the necessary cash processing facilities alternatively at their cash-feeding branches. Furthermore, Pakistan has a network of 19,519 Automated Teller Machines (ATMs) across the country supports the digital transaction ecosystem, with each ATM processing an average of 144 transactions per day. These machines facilitated 259 million transactions in FY24, amounting to PKR 4.3 trillion.

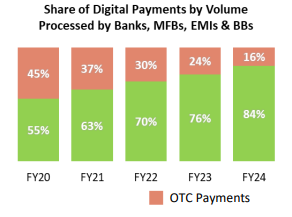

The landscape of retail payments in Pakistan has experienced a dramatic transformation over recent years. Historically dominated by cash, the payment ecosystem is witnessing a sizeable shift towards digital transactions. Data from the State Bank of Pakistan indicates that while cash payments once constituted the bulk of transactions, digital payments have surged dramatically over the past 15 years. The coronavirus (COVID-19) pandemic shifted consumer behaviour and further accelerated mobile and cashless banking adoption. This rapid digital uptake fueled by wallet transactions and mobile banking app-based transactions. ATM-based transactions also contributed to this growth, reflecting a broader trend towards digitalization in the retail payments space. According to SBP’s FY24 Payment Systems Review, digital payments now constitute 84% of all retail transactions, up from 76% in FY23.

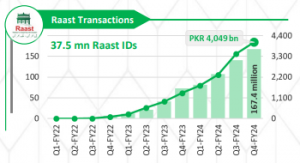

Raast, the country’s first instant payment system launched in 2021, has also simplified person-to-person (P2P) and person-to-merchant (P2M) transactions. This system offers instant, reliable, and free digital payments for individuals and businesses within Pakistan. This has extended financial services to the poor and the unbanked.

Despite these developments, a significant portion of Pakistan’s population remains unbanked and relies primarily on cash for everyday transactions. Although financial inclusion has improved substantially, approximately 64% of the adult population currently has access to a bank account, leaving around 36% unbanked. With a population of about 241.49 million, Pakistan continues to exhibit marked urban-rural disparities: approximately 38.8% of the population lives in urban areas, while 61.2% reside in rural settings, where access to modern banking and cash processing facilities is limited. Recognizing financial inclusion as a core mandate, the Pakistan’s central bank has set an ambitious target to increase bank account coverage to 75% of the adult population by 2028.

The Governor of the State Bank of Pakistan announced plans to introduce a new series of currency notes; the SBP officially began the process in January 2024 and aims to complete it over a two-year period. The primary goal is to modernize currency design with improved security features, enhance durability, and align with global standards. The State Bank of Pakistan has laid out a comprehensive plan to ensure a smooth transition across the financial and banking infrastructure. To facilitate this, SBP has mandated all banks to recalibrate their currency processing equipment to handle the new notes. The SBP has prepared a detailed framework for the eventual withdrawal of the existing banknote series. During the transition period, the current notes will remain legal tender and continue to be accepted for all transactions. Once the new notes are widely circulated, the SBP will begin the phased withdrawal of older denominations. Public awareness campaigns will be launched to educate citizens about identifying the new features and understanding the transition timeline.

While digital financial services are rapidly gaining traction, cash remains deeply embedded in Pakistan’s economy, particularly in rural and informal sectors, largely due to a significant unbanked population and varying levels of financial literacy. The SBP’s strategic initiatives from the CMS and CPCs to the introduction of Raast and the introduction of new series banknotes aim to modernize cash handling, improve financial transparency, and ultimately, foster a more secure and efficient economic environment. However, there is a crucial need to develop inclusive financial strategies that cater to the specific needs and challenges faced by communities especially in rural areas in accessing financial services.